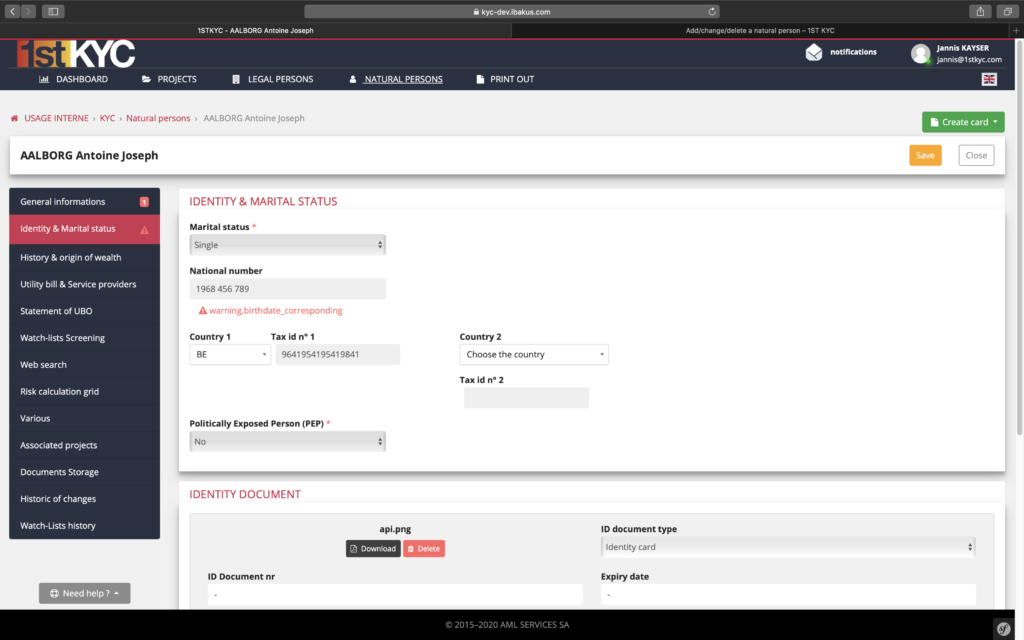

In this section you can enter information about the identity and marital status of the person. This includes information on the tax identification number, PEP check and ID card check.

To avoid errors when entering the tax identification number, the system checks the number with a server in the European Union and can thus check whether the structure of the number is correct and whether the number is genuine.

In addition to specifying the tax identification number, you can manually enter whether the person is a politically exposed person or not.

In addition to checking the tax identification number, it is essential to check the identification documents according to article 13 of the 4th Money Laundering Directive. For this reason, the system offers you the option of saving a copy of the identification document and checking it.

Although the system offers you to check the identification documents, you have the choice whether you want to or not. You can decide whether you only want to record the data and not check the ID documents, or whether you want to check the ID documents.

- Without checking: If you do not want the system to check the data, you only have to fill in the fields “Document type”, “Document number” and “Valid until”.

- With verification: If you want to have the data verified, you must upload a PDF of the identification document in addition to the fields “Document type”, “Document number” and “Valid to”. By clicking Save, the system will check the attached file and verify whether the document is authentic or not.

Finally, you can also assign an extract from the criminal record to the person. To do this, you must upload the extract from the criminal record in PDF format and specify the date on which the extract was made.

To save all the data, click on the “Save” button at the top right.