Trade Register and VAT

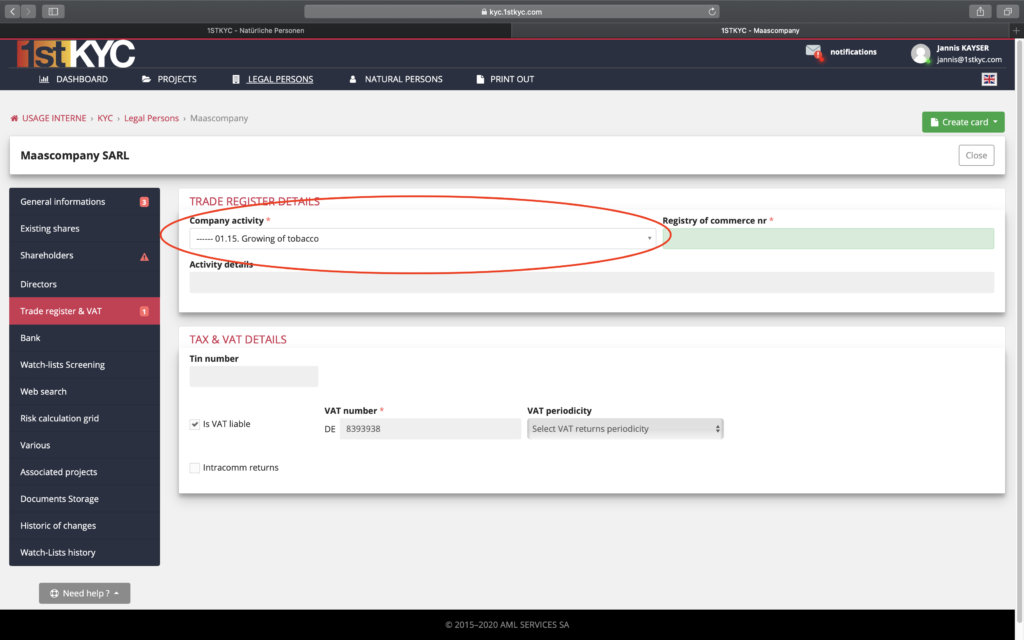

This sector refers to the activity of the enterprise, which is listed in official documents as a NACE code. If it is a new enterprise which does not yet have a NACE code, you can search for the activity of the enterprise by entering a word that refers to the activity. The system then searches for the corresponding NACE code.

It is essential to indicate the NACE code, as this criterion is included in the risk grid. The system recognizes the NACE code and automatically updates the risk grid.

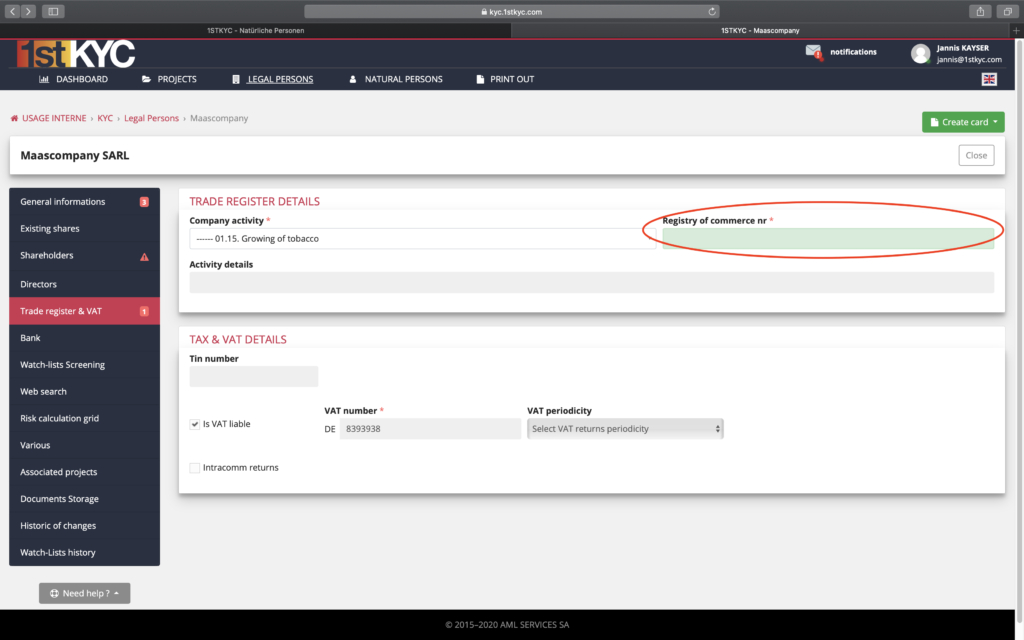

The commercial register number is also essential information and must be specified.

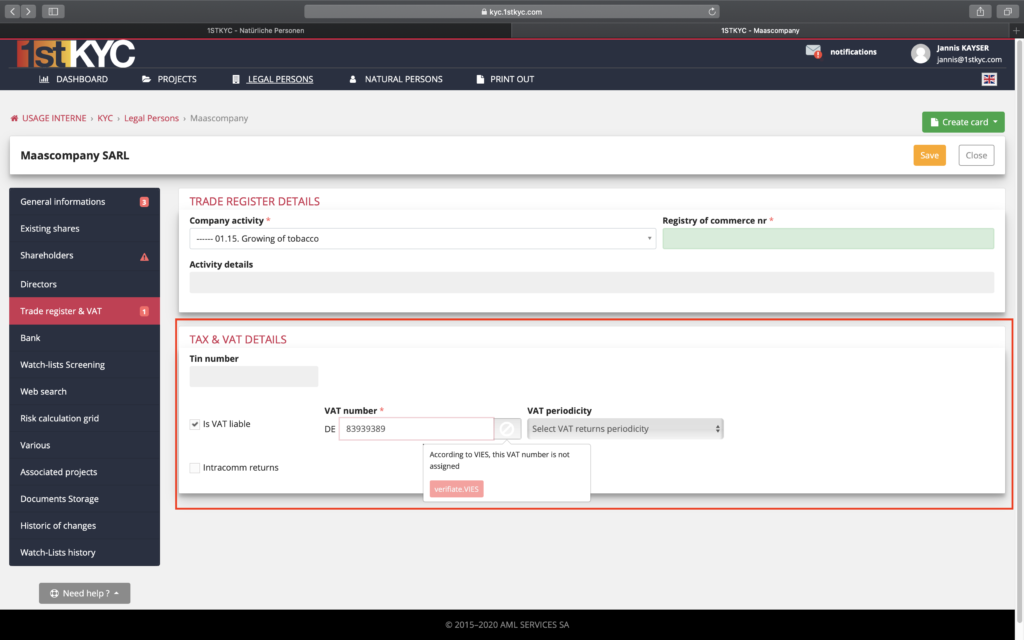

If the company is subject to VAT, you can enter the VAT information in the lower part. The VAT number is checked in real time using VIES. If the VAT number matches the name of the legal entity, a green sign is displayed. If the VAT number does not correspond to the name of the legal person, a red sign is displayed.